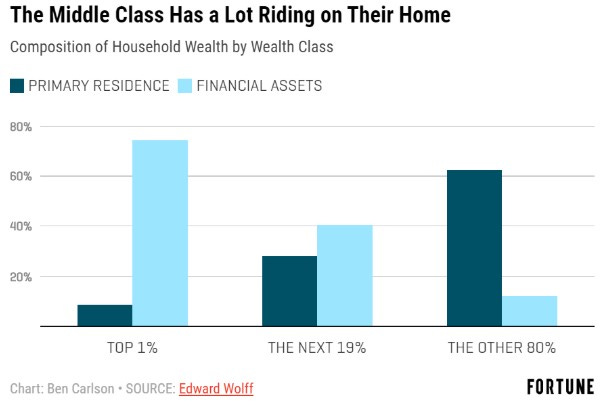

For the majority of Americans, their home is their biggest financial asset. And it’s not really that close. For the bottom 80% of Americans, two-thirds of their wealth is tied up in their primary residence while just 12% resides in other financial assets like stocks or bonds:

With housing being such an important financial asset for most people, the question that comes to my mind is: Is your home actually a good investment?

Let’s start by looking at some data.

For his book, Robert Shiller, a Nobel Prize-winning economist, put together a database of home prices in the U.S. going all the way back to 1890. Shiller showed that after adjusting for inflation, housing returned very little for homeowners over the long run.

From 1890 to 1996, the total real return (after inflation) for housing in the U.S. was a measly 13%. That’s an annual return of just 0.1% for more than 100 years.

While housing prices kept up with inflation during that period, this would be a disappointing result for most people when comparing those returns to other financial assets like stocks.

However, in more recent history, things have changed a little. From 1997 to 2006, housing prices shot up more than 70%, gaining almost 6% annually after inflation.

Then, as we all know, the housing market bubble burst and prices fell around 35% through the bottom of 2012. Since the bottom, housing prices have again shot back up 70% and are now much higher than they were at the peak of the mid-2000s.

With the spike in housing prices since the pandemic, there are a lot of people concerned about another housing crash. Yet this housing boom hardly bears a resemblance to the boom prior to the 2008 crash. Borrowers have much better credit profiles now. Borrowing costs are lower. People aren’t taking out risky adjustable mortgages with rates that will significantly increase after a few years.

There are a myriad of reasons for the crazy house prices of late including the pandemic, remote work, and low interest rates. But a huge reason is that millennials — the biggest demographic in America — are reaching the point in their lives where they want to settle down and buy houses and there’s simply a lack of homes for sale.

Ben Carlson wrote a few months ago:

“There were roughly 210 million people in the United States in the early-1970s and they were building more than 2 million houses a year. There are now 330 million people and last year there were less than 1.3 million houses completed.”

I’m watching the show 1883 right now (I would recommend it) and they have a hard time crossing rivers without people dying, so who knows how detailed their housing records were back then, but there has been an upward trend in housing returns over time:

Will this upward trend continue? Maybe. The combination of rising house prices and fewer houses being built seems like it’s created a situation where a home is probably a better investment option than it was in the past.

It’s difficult to calculate your actual return on your home because most people underestimate all of the ancillary costs involved like property taxes, insurance, maintenance, upkeep, renovations, and borrowing costs. In addition, almost everyone buys their home with leverage — and I’m not sure how Shiller takes that into account.

It’s also tricky to view your house as an investment because you have to live somewhere.

Your house could be worth double today than what you first bought it for, but in order to take those gains, you would have to sell your house. Unfortunately, selling your home involves frictions like realtor fees, closing costs, and all the pains that come from moving. Plus, you’ll have to find a new place to live that has likely doubled in price over the past few years as well.

Even if you downsize, it’s likely the price of the new, smaller home is now more than the bigger house you’re selling. Yes, eventually your house can be passed on to your family when you die, but rarely do people use the equity in their home to fund their retirement or other financial goals.

As I’ve said before, buying a house is more of a lifestyle decision than a financial one. There are a ton of emotions involved with a home purchase because it’s the roof over your head, part of your community and neighborhood, your school district, and a place you’ll make precious memories. There are other returns on a house that aren’t solely financial.

The conclusion I’ve come to is that housing is a cyclical investment opportunity and highly dependent on where you live. There are times where it can be a great investment and other times where it’s just a place you get to live while not necessarily making you rich.

Thanks for reading!

Interesting take on the subject! Your thought about "almost everyone buys their home with leverage" made me think of a book. I recently read "Money Magic" by Laurence Kotlikoff and he writes an interesting chapter about mortgages and home buying. His point was more along if you have a mortgage but also invest in the market you are essentially borrowing against your home to invest in the market. He seems to suggest, if you are able, prioritze paying off your mortgage. You article is an interesting spin because it highlights the fact that your home is an investment. Who has the crystal ball to see which investment will do better in the long run?!