How to Grow Your Net Worth

Because open discussions about money are considered taboo, and comparing your own personal financial situation to your friends isn’t very effective, it can be difficult to know where you stand financially. Amongst the many different measurements used to determine financial success, net worth is the most basic and widely used. While it’s not a perfect metric, it’s important to know what it is so you can evaluate your financial health and make plans for the future.

Net Worth = Assets - Liabilities (Debts)

Assets are anything of value that you own that can be turned into cash (house, car, cash, stocks, etc.). Liabilities are debts that you owe to others (mortgage, car loan, credit card debt, student loans, etc.). The difference between the two is how much you really own — your net worth.

Net worth is a snapshot of your current financial position and the product of everything you’ve saved and spent up until now. It shouldn’t be considered the ultimate indicator of financial success or failure because it doesn’t tell the whole story. For example, you could have a low or negative net worth because you’re early on in your career or you decided to take out student loans to help boost your earning potential. However, tracking your net worth over time will let you know if you’re moving in the right direction.

Via Tenor

Although I’m not a big fan of comparisons because everyone’s situation is different, I do think it can be useful to see where you stand using an objective benchmark like net worth. The following chart shows the median net worth in America sorted by age and education level. It can give you a sense of where you’re at and what’s possible:

Eventually, the goal is to grow your net worth to the point where you can live off of the assets you’ve accumulated. When that happens work is truly optional and you’re completely financially independent.

There are three ways to grow your net worth:

Savings

Early in your career, how much you save will account for most of your net worth growth. In order to translate your income into wealth, you need to save money so you can build assets. Your net worth isn’t determined by how much you make but by how much you keep.

Make a plan to save a portion of your income. It’s the most important thing you can do to start growing your net worth. If every dollar of your paycheck is going toward living expenses you’re not making any progress. Your net worth doesn’t increase unless you set aside money for yourself.

Via Tenor

Debt Reduction

Debt can be a powerful tool that can aid you in buying assets that you wouldn’t have been able to afford through saving alone. Taking out debt may initially decrease your net worth, but it can provide you an opportunity to grow that otherwise wouldn’t have been available.

Reducing debt directly increases your net worth. For those who are uncomfortable with debt, you can make extra payments to get rid of it as soon as possible. Or you can stick to your original payoff schedule and use your excess cash in other areas. You’d be surprised at how much progress you make by just making minimum payments on your loans. Every time you make a monthly debt payment, you’re growing your net worth.

Via Tenor

Asset Growth

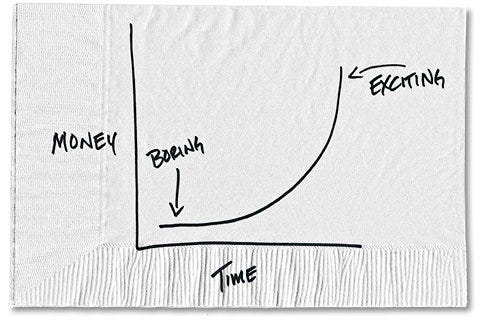

While saving and reducing debt will be the primary driver of net worth when you’re starting out, asset growth will do the majority of the heavy lifting later in your career.

As you buy assets, whether that’s a business, real estate, or stocks, the hope is that they’ll increase in value. Although you don’t really have control over how much your assets will grow, you can pick smart investments and stay the course. It’s impossible to predict how the real estate market or the stock market will perform from year to year, but over time these markets become more reliable. Keep buying and play the long game. This is especially true for investing where you can take advantage of compounding returns the longer you remain invested.

Even though growing your net worth is as simple as adding assets and reducing liabilities, it’s not easy to do. It takes time and discipline. You need to have good saving and spending habits, manage debt properly, make smart investment decisions, etc. Coordinating all of these efforts so they work together is how you build wealth. While no single financial metric is perfect, net worth is a pretty good indicator of your current financial security and lets you know if you’re moving in the right direction.

Thanks for reading!