How Much Money Is Considered Rich?

The other day I was asked, “how much money do you need to have to be considered rich?” This is an interesting question because the answer depends on how you define rich. Wealth is relative.

There are really only two ways to measure how you’re doing financially: against yourself and against others. Since measuring your financial progress against yourself is nuanced and personal, it’s usually simpler for people to just compare their progress to other people.

While I think that using personal, internal benchmarks is a better way to measure financial success, I understand the allure of wanting to know where you stand compared to others. So, I’ve gathered some data that you can use to measure yourself against:

Nearly 40% of households in the U.S. earn less than $50,000 a year and two-thirds make less than six figures. If you make over $150,000 a year as a household that would put you in the top 18% of income-earners in the country. On an objective basis, that would be considered rich.

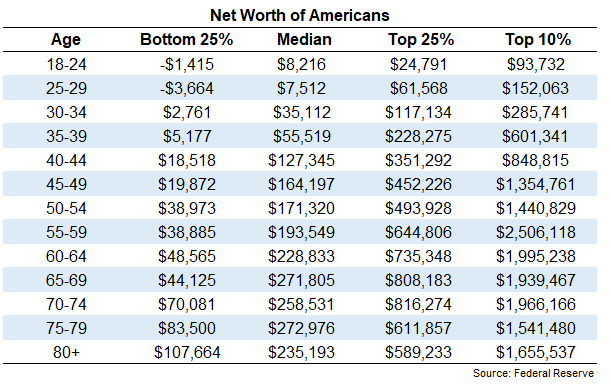

You could argue that income doesn’t necessarily translate to wealth and that net worth would be a better measurement. The latest data shows median household net worth in the U.S. was a little more than $121,000 in 2019. Here’s a list of median net worth segmented by age:

These numbers are likely to be lower than actual net worth data today because asset prices and house prices have risen a healthy amount since 2019, but they should still be similar.

Here’s another graph breaking down median net worth by percentiles:

Using the same logic as we did with income, I think it’s reasonable to say that if you have a net worth in the top 25% for your age group that would objectively be considered rich.

However, when I show people data like this it doesn’t resonate with them. In my experience, people don’t care that much about how they’re doing compared to the median or the average. We don’t want to compare our situation with a random person across the country, what we really care about is how we’re doing compared to our colleagues, neighbors, friends, and family members.

But there are problems with measuring your financial success to those around you. For one, others’ success can often be deceiving because only their accomplishments are being advertised while the hard, painful parts of their lives are usually hidden. Almost everything looks better from the outside.

Additionally, being preoccupied with others’ successes can cause serious FOMO and ill-advised financial decisions that may not be best for your personal situation. Not to mention that it’s hard to know how much of people’s successes are due to luck versus skill.

If you solely measure your financial success relative to the others, you’ll end up on a neverending path of feeling inadequate, incompetent, and poor. There will always be someone smarter than you, more popular than you, better looking than you, and someone getting richer faster than you.

This is why I believe it’s more useful to measure how you’re doing financially against yourself instead of others. Focus on how far you’ve come relative to where you began. That should give you a good view of where you stand and what you’ve accomplished. Figure out where you want to go and what being rich looks like to you.

In my opinion, the best way to grade financial success is by whether you’re happy and fulfilled, which varies from person to person.

Working 80-hour weeks and squeezing every penny out of your time and career is the ultimate goal for some people. But it’s a nightmare for others whose priority could be spending quality time with their family. Using a benchmark like net worth to compare those two groups of people would be meaningless.

I recently read a story about a financial advisor who has a client that actually gets angry when hearing about portfolio returns or benchmarks. As a fellow financial advisor, I can confidently say this mentality is rare. But none of that stuff matters to this particular client. All he cares about is whether he has enough money to keep traveling with his wife. That’s his only benchmark.

“Everyone else can stress out about outperforming each other,” he says. “I just like Europe.”

Maybe he’s got it all figured out.

Thanks for reading!