Why Stocks?

As of 2021, 56% of American adults are investing in the stock market. And of that 56%, only around 10% are invested in stocks outside of their company retirement plan. While this number is up from 32% of households owning stocks in 1989, it hasn’t really changed since 2001. More people need to be investing their money.

Why? Because you can’t save your way to financial independence.

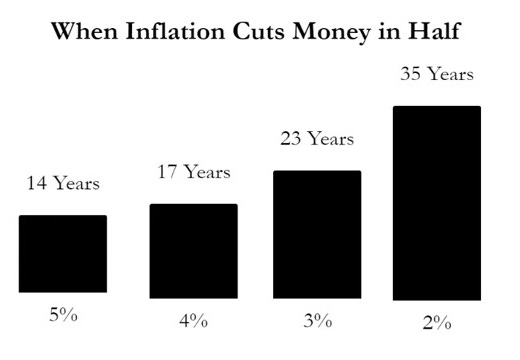

Let’s say you make $100,000 per year and have a healthy savings rate of 20% (well above the current U.S. average of 11%). At the end of a 30-year career, if you simply put your savings into a bank account, you’d have accumulated $600,000. However, because of inflation which has averaged around 3% per year, in 30 years that $600,000 would actually only be worth $248,000 in today’s dollars.

In contrast, let’s say rather than stashing your money into a bank account you decided to invest it instead. Since 1928, the U.S. stock market has grown 9.8% per year — so nearly 7% more than the annual inflation rate. Using the same savings numbers above, at the end of a 30-year career, with a 7% annual return after inflation, you’d have accumulated $1,889,593.

That’s quite the difference in outcomes. Investing in appreciating assets will turn your savings into meaningful wealth.

Now, investing isn’t limited to only buying stocks. Some people would prefer to start their own business or invest in real estate, bonds, cryptocurrency, NFTs, art, sports cards, etc. Each investment is different and comes with its own pros and cons. Everyone has different talents, risk preferences, and priorities that will determine which type of investment best suits them. There’s no singular path to wealth.

Although, today I briefly wanted to hit on a few points that make the case for stocks.

Liquidity

One of the best investment traits of stocks is that they are highly liquid, meaning that they can be sold for cash quickly. As opposed to other types of investments which may take weeks or longer to find a buyer and get out of the investment, stocks can be sold almost instantly and you can get your cash in a few short days.

Now, the ability to cash out of your stocks easily is a double-edged sword. Because stocks are so liquid, people have a tendency to over-trade and panic-sell more than they would with an illiquid investment — which is harmful to long-term returns.

But life is unpredictable and you never know when you may need the money you’ve stashed away. Flexibility should be an important factor when deciding where to invest your money, especially when you’re young.

Diversification

There are approximately 45,000 to 50,000 publicly traded companies listed on stock exchanges throughout the world. Investing in stocks makes it easy to spread out your risk and not put all of your hard-earned savings into one proverbial basket.

Because there are so many companies to invest in, stocks allow you to be more diversified than, let’s say, a cryptocurrency that basically performs similarly to large tech stocks. Or a single investment property that’s subject to local market conditions. Or a collectible whose value fluctuates based on nostalgia and other emotional factors. Or your own small business which succeeds or fails based on your own efforts.

With stocks, you’re able to invest in companies of different sizes, in different sectors, and across different countries. You can have a diversified portfolio with as little or as much money as you have available to invest.

By diversifying you avoid having a single point of failure in your investment portfolio. Sure, you may miss out on some home runs, but you’ll never strike out either.

“The only investors who shouldn’t diversify are those who are right 100 percent of the time.” – John Templeton

Higher Returns

From 1926 to 2020, the average return for the U.S. stock market was basically 10% per year. More than one-third of all years have even seen a gain of 20% or more. The worst 30-year return was 8% per year from 1929 to 1958. And remember, an 8% return over 30 years equates to a nearly 900% total return. Not bad for the worst result ever.

Historically, stocks have provided higher returns than any other asset class. This includes bonds, gold, silver, oil, and even real estate. Of course, there have been periods where one specific asset class will perform better than all the others, but a diversified portfolio of stocks has delivered the best, most reliable long-term returns.

Return on Hassle

Not only do stocks offer high long-term returns, but they’re a great investment because they require no ongoing maintenance on your part. You own the business and reap the rewards while someone else runs the business for you. You don’t have to be involved. If structured properly, stocks are a truly passive investment.

Rather than simply making a financial decision based on the potential return on investment, you should also consider the return on hassle.

Return on hassle is calculated by taking:

The amount of money you’ll save or earn

divided by

The time, effort, money, and stress it takes to achieve those returns

Let’s say you’re in the market for a new couch and you want to get the lowest price possible. So you spend hours scouring the internet, drive to multiple different stores, haggle with the salespeople, get into an argument with your spouse because they just want the couch already, and in the end, you do get the lowest price.

You won… but was the discount really worth all the time, stress, and hassle? Maybe it was. That’s for you to decide.

“Everything has a price, but not all prices appear on labels.” — Morgan Housel

Some people have a hard time distinguishing the difference between an investment and a second job. Personally, I like the idea of passive investments, but an active lifestyle.

What passive stock market investing lacks in excitement, it more than makes up for in the free time it provides. It allows you to grow wealth while focusing on what really matters, which is living your life.

Thanks for reading!