Why Don't People Save For Retirement?

More than half (54%) of all families in the United States have no retirement savings at all.

The median retirement savings for people approaching retirement (ages 55-64) is $185,000. No matter how frugal you think you are, you can’t live for very many years on $185,000 these days.

Now, I understand that retirement doesn’t mean the same thing for everyone. An increasing number of people I talk to mention they don’t plan on a traditional retirement and want to keep working until they physically can’t anymore. That’s fine.

But the future is unpredictable. You never know if/when your body or mind might fail you, you may get fired, your industry could get disrupted, or perhaps you become more exhausted at the end of your career than you thought you’d be when you started at age 30.

Regardless of future financial goals, everyone needs to save money. I think everyone knows this, and yet, too many of us don’t save nearly enough.

Here are three big reasons, based on my own observations, why people don’t save for retirement:

Low Income

The primary reason people don’t save for retirement in America is they simply don’t make enough money. As of 2023, the median household income in the U.S. is around $80,000. If you’re an average family of four living on that income, there’s just not a lot of money left over to save.

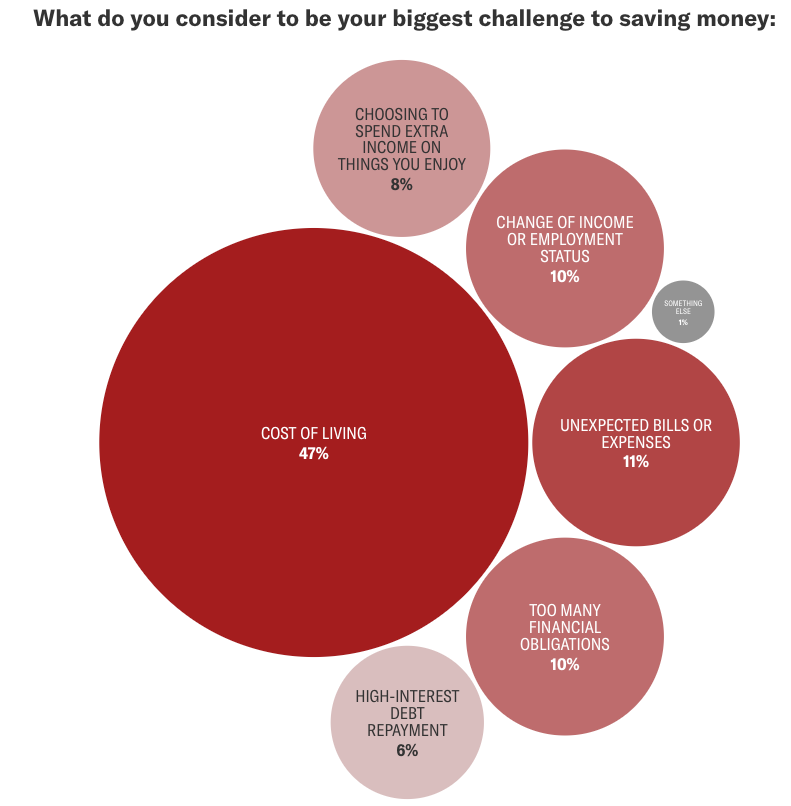

The following visual is from a survey conducted by Yahoo Finance:

To me, all of the reasons listed above fit into the category of not having enough money. There’s a baseline amount of costs in order to live a decent life that you can’t get around — you can only reduce your expenses to a certain extent. With salaries plateauing and basic expenses such as housing, education, and child care continuously rising, a typical salary doesn’t go as far as it used to toward covering the necessities.

There’s a reason the top 10% of income earners save so much more money than the other 90%.

So, if possible, prioritize increasing your income. Invest in yourself to boost your earning potential. The more you make, the more you have to save. Unless you’re an extravagant spender, the best way to increase your savings isn’t by canceling your Netflix subscription or buying less coffee, it’s by increasing your income.

Temporal Discounting

Even for those who do have money to save for retirement, it’s still not always a priority. The financial issues we’re dealing with now seem so much more important than the needs of our future self. An old, but fantastic, bit from Jerry Seinfeld explains how this works:

The scientific term for our bias towards current problems over future problems is called temporal discounting. To use Jerry’s terms, having money for retirement is “retirement guy’s” problem, not “today guy’s” problem. The dilemma is that retirement guy is completely dependent on today guy. Without the help of today guy, retirement guy has no money.

Although it’s difficult, try to take some time to think about your future self. One way to help your future self out is to automate your savings. Willpower and desire come and go, so trying to remind yourself to save every month doesn’t work. Pick a savings amount and an automated cadence that works for you and let it ride. You can’t save what’s leftover; you have to spend what’s leftover.

Analysis Paralysis

Planning for retirement can be an overwhelming process. There’s a lot of guesswork involved when planning for something 30+ years down the road. When will you retire? What will you do in retirement? How much money will you need? How much should you be putting away each month? What investment accounts should you use? What investment returns do you need?

Because there’s so much to figure out, a lot of us simply put it off for another day. Then the days turn into years and the years turn into decades, and when the time comes — when you can no longer ignore retiring — you painfully realize that you’re behind.

You don’t need to know exactly what your future is going to look like to put together a tentative plan and to start saving. Compounding works in favor of those who start early. Start small and build good habits. You can adjust your plan along the way as you get more clarity about what you want.

“Life is amazingly unpredictable; any 22-year-old who thinks he or she knows where they will be in 10 years, much less in 30, is simply lacking imagination.” — Ben Bernanke

We can’t predict the future. Who knows what the stock market will do, what will happen with inflation, tax law, your health, job situation, the list goes on and on. When planning for retirement, the only thing you can really control is how much you save. The good news is that saving is the most important factor in determining retirement preparedness.

The stock market has produced awesome returns for the last 40 years, yet we still have a retirement crisis. So, we don’t have an investing problem; we have a savings problem. If you ask someone who’s about to retire what they wish they would’ve done when they were young, I can guarantee most will say they wish they would’ve started saving earlier.

Thanks for reading!