What Really Makes Us Happy?

One of the longest studies on human happiness started in 1938 and followed the lives of two groups of men. The first group began participating in the study when they were sophomores at Harvard and the second group was boys from Boston’s poorest neighborhoods. Known as the Harvard Study of Adult Development, it tracked everything about these men over decades—from their health and their careers to their relationships with others.

After analyzing the lifetimes of data, the researchers came to what may seem like a surprising conclusion:

“Close relationships, more than money or fame, are what keep people happy throughout their lives.”

Although the two groups of men had varying levels of career success ranging from a President of the United States to a high school janitor, the researchers found that the quality of one’s relationships was more predictive of happiness than any other factor. The study eventually expanded to include their wives and children and the findings were the same.

According to Robert Waldinger, the 4th director of the study, relationship quality was even a better predictor of overall health than many traditional health markers. In his TED Talk he says:

“When we gathered together everything we knew about them about at age 50, it wasn’t their middle-age cholesterol levels that predicted how they were going to grow old. It was how satisfied they were in their relationships. The people who were the most satisfied in their relationships at age 50 were the healthiest at age 80.”

The Harvard study tells us that investing in our relationships is just as, if not more important, than investing in the stock market, or real estate, or some random cryptocurrency.

A lot of personal finance is dedicated to figuring out how to effectively keep and grow your money, which is very important and necessary. However, study after study shows that happiness isn’t correlated to how much money you’ve accumulated, but rather how you choose to spend the money you have.

What’s interesting is the spending choice that has the biggest impact on a person’s happiness is how much money they spend on others. One study revealed that those who spent as little as $5 on someone else throughout the course of their day were happier at the end of the day than those who only spent money on themselves.

I understand that spending money on other people is counterproductive to the goal of building wealth, but there are plenty of financial decisions that will have a negative impact on your net worth but a positive impact on your life.

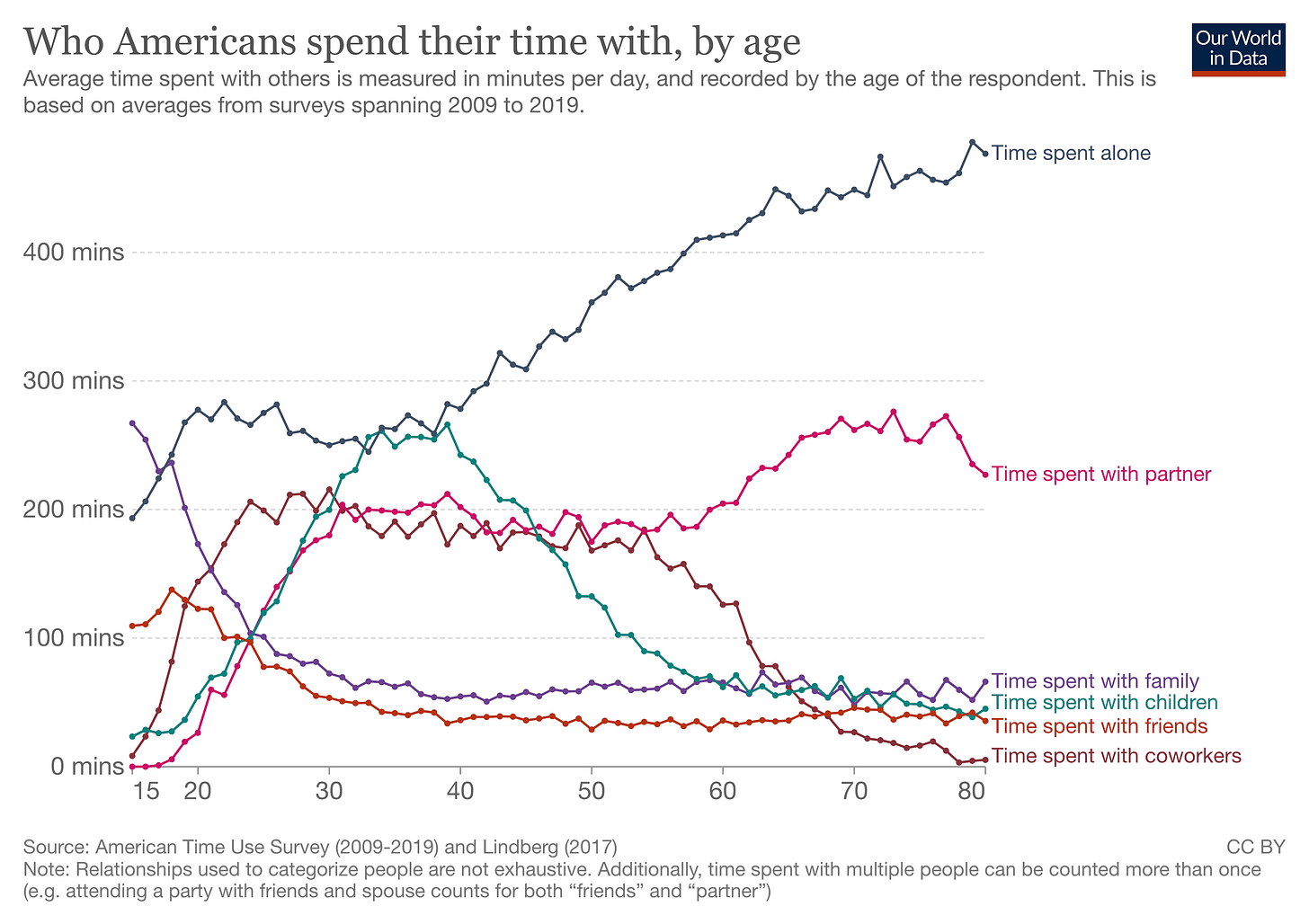

The following chart maps out how we spend our time over the course of our lives:

You can see that time spent with friends and family starts to decline in your 20s and never really recovers. The research shows that friends and family slowly move out of your life as you age and you start to spend more and more time alone.

The large gap between time spent alone and time spent with others toward the latter part of our lives is sad. I am a huge proponent of saving money but life is too short to save everything. Too many people give up too much during their lives for the sake of more money at the end of their lives.

Many times, it’s money they’ll never fully spend anyways. United Income reported:

“The average retired adult who dies in their 60s leaves behind $296k in net wealth, $313k in their 70s, $315k in their 80s, and $238k in their 90s.”

Rather than trying to be the richest person in the cemetery, we would all benefit from spending more time and money on building quality relationships with the people we care about.

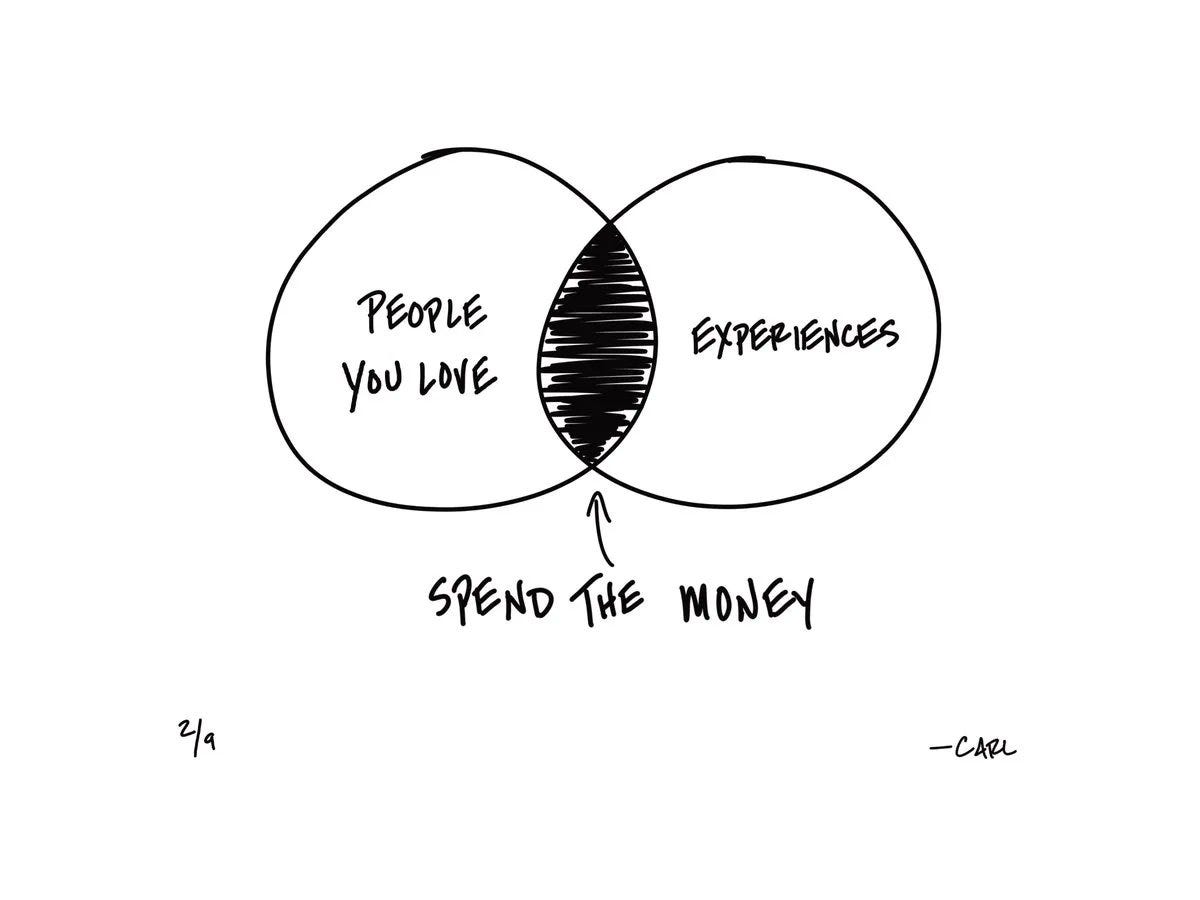

Carl Richards explains this point simply in this sketch:

As Mr. Carson from the show Downton Abbey once remarked:

“The business of life is the acquisition of memories. In the end, that’s all there is.”

Thanks for reading!