What Are Mutual Funds?

“I don’t like mutual funds.”

This was a comment someone made during a Q&A session at the end of a presentation I was recently hosting. The comment caught me off-guard and was so surprising to me that I had to dedicate a post to it.

Following up on this broad, sweeping remark, I asked, “Well, why not?”

“I just think they’re a horrible investment.”

Ok. Fair enough.

But from that answer, I was able to deduce this person may not have the best understanding of mutual funds. And I don’t blame them at all. Investing can be a hard topic to understand and is never really taught to us in school. I didn’t know what a 401(k) was until well into my personal financial planning coursework in college.

I figure if there’s one person who is a little lost on what a mutual fund is, then surely there must be others in the same boat who just haven’t admitted it.

So, let’s do a brief, educational review on mutual funds.

To start, a mutual fund is not an investment. It is an investment product or vehicle that holds investments like stocks, bonds, commodities, or other securities.

Simply put, a mutual fund is a basket of stocks.

If you’re a day trader or only believe in picking a handful of individual stocks like Apple or Tesla, you probably don’t have much use for mutual funds. However, if you’re looking to be more diversified with your investments, a mutual fund is a great option to give you access to a broad range of investments all in one place. Instead of having to pick and choose hundreds or even thousands of individual stocks, you can buy a single mutual fund.

Mutual funds are a convenient way to access diversified, professionally managed portfolios.

The type, quality, volatility, and projected returns of the mutual fund will be determined by the underlying investments within the fund.

There are approximately 137,000 mutual funds to pick from.

To make things even more confusing for investors, there are these things called exchange-traded funds or ETFs.

Mutual funds and ETFs are very similar in the sense that an ETF is also a basket of investments. The main difference is that you can buy and sell ETFs during the day at different prices like a stock, whereas a mutual fund only trades once a day after the market closes.

Typically, ETFs are viewed as being more passively managed than mutual funds and therefore have lower fees. However, that’s not always the case. There are actively managed ETFs and passively managed mutual funds. There are high-fee ETFs and low-fee mutual funds. It all depends on the specific fund.

An example of a passively managed mutual fund would be an index fund.

Index funds are a type of mutual fund or ETF that is designed to mimic a financial market index. For example, the S&P 500 is the most popular market index, it is composed of the 500 largest companies in the U.S. An S&P 500 index fund gives you exposure to those 500 companies.

All index funds are mutual funds or ETFs, but not all mutual funds and ETFs are index funds.

When buying a mutual fund or ETF, one thing to pay attention to is what’s called the expense ratio. An expense ratio is the fee charged to operate the fund. For example, the expense ratio for Vanguard’s popular S&P 500 ETF, VOO, is 0.03%. Meaning if you have $10,000 invested, you’ll be charged $3 per year to be in that fund.

Alright, I know that’s a lot of definitions and investing lingo, but I hope that’s a helpful review.

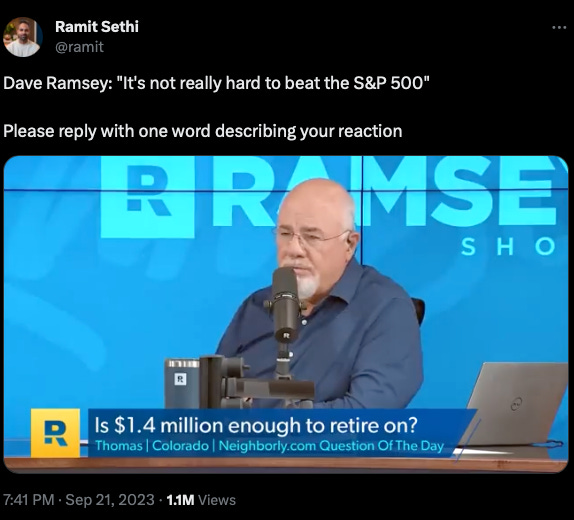

I wanted to finish with a semi-unrelated, maybe more interesting, point. A video of Dave Ramsey was circling Twitter a few days ago where he’s found saying it’s not hard to beat the S&P 500 and his portfolio of mutual funds has averaged over 13% annually for the past 30 years:

I don’t really have any strong opinions about Dave Ramsey, good or bad. But I do think it’s important to try to stick to the facts and historical data when it comes to these very influential financial influencers.

Per Meb Faber and Morningstar data, over the past 30 years, not a single mutual fund has returned 13%. Not one.

How many have returned 12% per year over 30 years? Five. Not 5%, 5 total.

Rather than Dave saying, “It’s not really hard to beat the S&P 500,” I think a more appropriate phrase would be, “It’s not really hard to beat the market in the long run, it’s almost impossible.”

Thanks for reading!