The Right Place at the Right Time

Although we realize luck plays a significant role in our lives, we hardly talk about its role when it comes to building wealth or becoming successful. For the successful, attributing success to luck hurts their ego, and for the unsuccessful, the absence of luck is an easy excuse to fall back on. However, whether we like it or not, luck matters.

It’s comforting to believe that effort and skill directly lead to success. Admitting that we might not have as much control over our own success as we think we do is a scary concept. In reality, there are things in life that happen outside of our control that have a bigger impact on outcomes than anything we did intentionally.

Obviously, luck isn’t everything. Talent, passion, discipline, and hard work matter a lot. But these attributes are usually the minimum requirement for being successful, not a guarantee. There are a lot of people who work hard and aren’t rich.

I would like to give two quick examples of how luck shapes success in careers and in investing:

Bill Gates, who is one of the most respected and successful people of his generation, in his own words admits to being on the receiving end of incredible luck.

In 1968, only 0.01% of high school kids in the world had access to a computer. When he turned 13, his upper-class background and private education landed him in Lakeside School. As it turned out, this specific school in the suburbs of Seattle was the only school in America that had a computer. Which, during this formative time of his life, he and his buddy Paul Allen were able to use whenever they pleased.

Yes, Bill Gates is a genius, exceptionally talented, and very hard-working. At the same time, the circumstances that kick started his career and success were largely outside of his control. He benefited from being in the right place at the right time.

Via Giphy

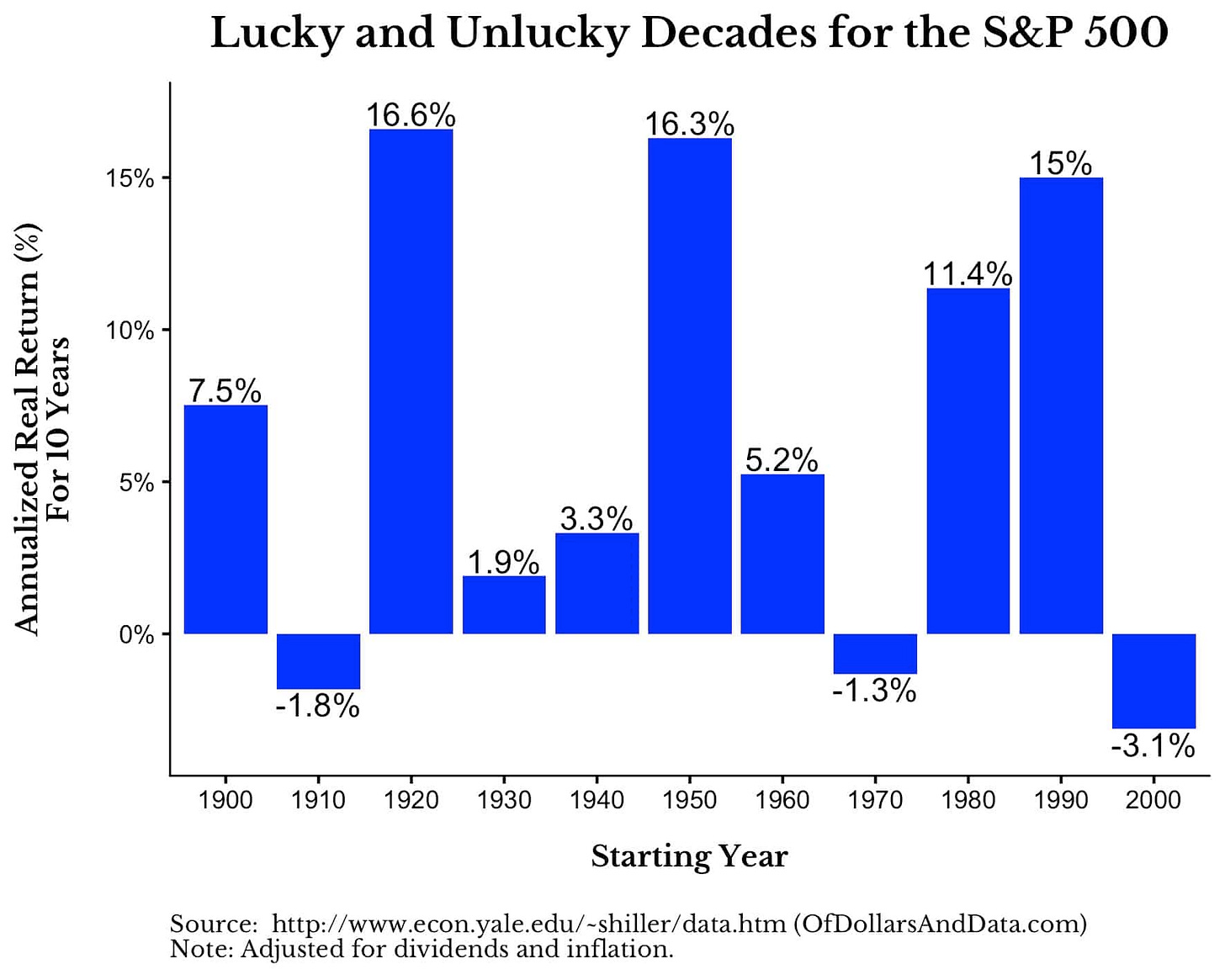

When it comes to investing, luck has a significant impact on results. In fact, the year you were born, and consequently the year you start investing is will likely be the most important driver of your investment returns.

The following chart shows what the stock market was doing when each generation turned 22, the age when most start investing. As you can see, each generation has to deal with different market conditions.

If you had invested from 1960-1980 and beaten the market by 5% each year, you would have made less money than if you had invested from 1980-2000 and underperformed the market by 5% a year.

Of course, there are ways to make money in bad markets and ways to lose money in good ones. Yet just as rising tides lift all ships and treacherous waters sink them, the headwind or tailwind you receive from the overall market when you start investing will have the biggest impact on your investment returns.

So, why is acknowledging luck important?

The truth is, the circumstances that led to the success of the people we admire will never be repeated. Understanding that, we can be more careful about the lessons we take away from their stories. The tips and tricks that they used to get where they are worked for them, but may not work for you. The following comic illustrates this point:

Dumb decisions can lead to good outcomes and vice versa. Don’t judge a decision or a process based on the outcome. When it comes to making decisions for your own career or your own finances, focus on what you can control. Be consistent with your efforts, do what’s best for your own unique situation, and live with the results. Hopefully, you can get some luck along the way.

Thanks for reading!