The Problem With Market Timing

I’ve been writing about an impending recession for quite a while now. Last May, I wrote a post titled “Preparing For a Recession.” A month later I made a post called “Are We Entering a Recession?.” Then in November, I wrote another post about “Waiting For a Recession.”

And based on conversations I’ve had over the past few weeks, many people still remain convinced that an economic downturn is just around the corner.

Are these people right? I have no clue.

Despite concerns about the continual rise of interest rates and ever-present inflation and bank failures, the labor market continues to be strong. In May alone, 339,000 new jobs were created marking the 29th straight month of positive job growth. On top of that, unemployment is at the lowest rate since 1970.

And judging by my own experience trying to book insanely expensive flights and hotels for a vacation this summer, people are still vacationing and spending liberally which is the opposite of what happens during a recession.

As of now, things haven’t gotten nearly as bad as most people seem to think they will, but who knows what the future will hold. There could be a recession this year or next year or four years from now. What we do know is that we will have a recession at some point. On average, a recession has occurred once every 5.9 years dating back to World War II.

If economic activity is going to drop as consumers start spending less (which leads to revenue declines for businesses and therefore lower business valuations) then it would make sense to cash out of your stocks before their prices fall.

Right?

Well, in theory that makes sense. But if you get the timing wrong, it could prove disastrous to your investment returns.

As I mentioned, I’ve been having conversations with people worried about an upcoming recession for months now. And if you had acted on those worries by cashing out of your investments or stopping contributions to your investment accounts at the end of last year, you would have missed out on some significant investment growth.

Amidst all of this fear and concern, the stock market has quietly been on a run over the past several months.

The U.S. stock market is up 12% so far this year and is up a whopping 20% since last October.

The problem with getting out of the stock market is you then have to figure out when you’re going to get back in. And if you miss out on just a few of the best-performing days in the market, it can drastically impact your overall investment performance.

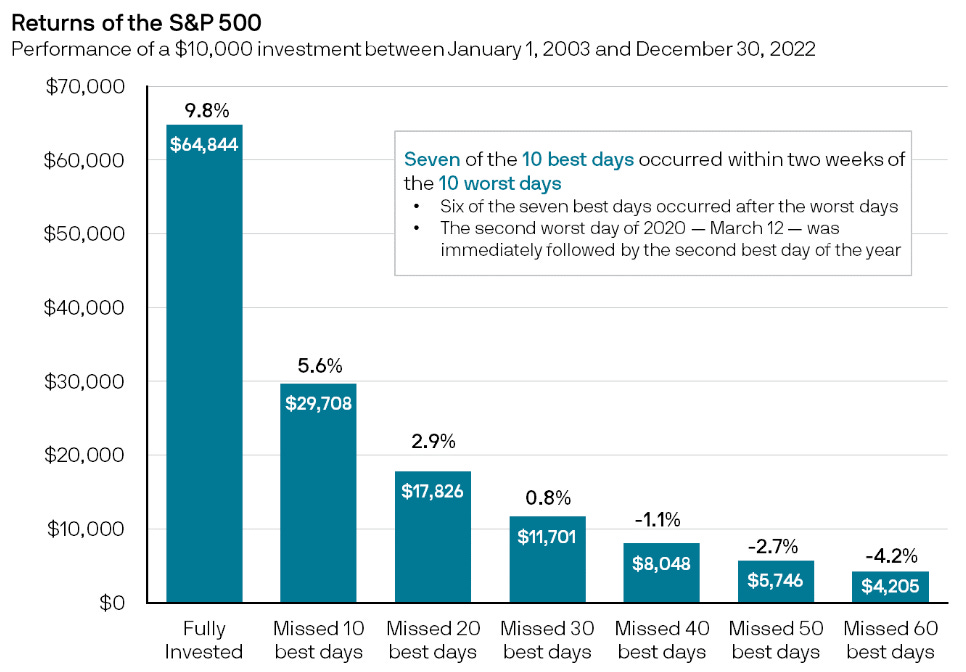

The following graph from J.P. Morgan illustrates this point:

During a 20-year time period, there are about 5,060 trading days. If you missed out on only 40 of the best-performing days you would have received a negative total return over that span. You can go from multiplying your money by six to having much less than you started with by just missing 40 days out of 5,060.

Now you may be thinking, “Yeah, but isn’t it relatively easy to not miss the best days? If I’m cashing out when the stock market is crashing, how likely am I to miss out on one of those best days?”

As it turns out, pretty likely. Seven of the 10 best-performing days occurred within two weeks of the 10 worst days. Volatility tends to cluster — the best days in the market are often concentrated around the worst days in the market.

The majority of your investment returns are built on just a few good days or weeks of market performance. The only way to guarantee that you’ll be able to take advantage of the best days is to stay invested and stick around during the worst days.

Peter Lynch (legendary investor) once said:

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

Thanks for reading!