In my post a couple of weeks ago about the stock market and the presidential election, I mentioned that I had spoken with some people who were waiting to invest their cash until after the election. They were afraid of a downswing in the stock market due to uncertainty about who would win and a possible contested election. They wanted to let the dust settle before they decided to do anything with their money.

Last Monday, the first trading day after Joe Biden was officially projected to be president-elect, the stock market did the exact opposite of what many predicted; it shot up. Almost all travel and leisure stocks rose which propped up the U.S. market. Market commentators attributed the increase to the news of a new president, the announcement of a possible vaccine for COVID-19, and hope of a new government stimulus package. Regardless of what factors actually caused the surge, it was a good day to own stocks.

This “good day” in the stock market caused me to wonder how important is it to be in the stock market and take advantage of these days?

I would guess that the people who were trying to time the market by waiting for the election to pass are a little bummed that they missed out on some gains that could’ve been theirs. I would also guess that they’re still waiting around and telling themselves that they’ll be sure to get in for the next market surge. That may be true, but you can’t keep missing out on too many of these “good days” before you start to see a negative impact on your long-term returns.

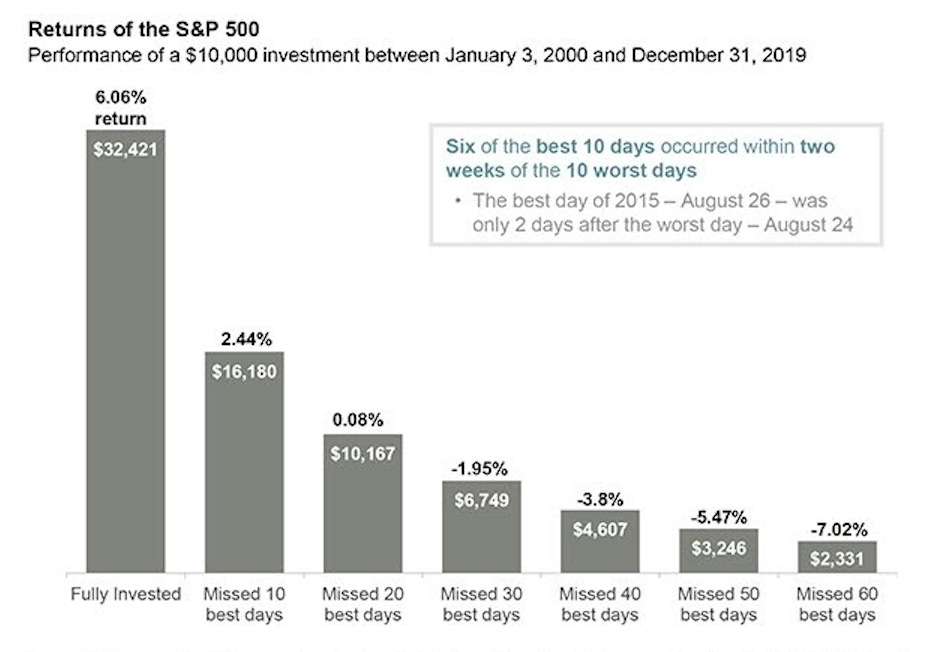

The following graph from J.P. Morgan shows how missing only a few days of strong returns can drastically impact your overall performance.

During a 20 year time period, there are about 5,060 trading days. If you missed out on 30 of the best performing days you would have received a negative total return over that span. You can go from tripling your money to having much less than you started with by just missing 30 days out of 5,060.

The task of picking those good days goes from hard to impossible when you understand that the best days and the worst days often happen close together. Over the past 20 years, six of the 10 best days occurred within two weeks of the 10 worst days.

We saw this happen this year. After news of COVID-19 quickly spread, the S&P 500 experienced the fastest recession in history, dropping around 39%. However, this dramatic drop was overshadowed by an even faster recovery. In only a little over 100 days, the market recouped all of its losses and soared upward 50% to set a new all-time high. Many people who sold their declining stocks due to fear of the pandemic realized too late that they had also missed out on one of the greatest bull markets in history.

Harvey Dent summarizes this phenomenon nicely in one of my favorite movies:

“The night is darkest just before the dawn.”

Time in the market beats trying to time the market. The majority of your investment returns are built on just a few good days or weeks of market performance. The only way to guarantee that you’ll be able to take advantage of the best days is to stay invested and stick around during the worst days.

Thanks for reading!

Great article. This should be required reading for all investors