Some Thoughts on Income

How much money do you need to make to be in the top 10%, top 5%, and top 1% of income earners?

Nick Maggiulli recently published an article, How Much Income Do You Need to Be Rich?, that contained various types of income statistics for Americans which answer the above question. I saw people engaging with and sharing the data on Twitter, so I figured it would be interesting to share some of it here as well.

After sharing the article on Twitter, Nick later tweeted that this particular post received double the views of his average post. In news that’s shocking to nobody, people like to compare their finances to others.

However, there are some issues with measuring your financial success based on other people. To start, others’ success can often be deceiving because only their accomplishments are being advertised while the difficult, painful parts of their lives are usually hidden from view. Almost everything looks better from the outside.

Additionally, when it comes to money it’s hard to know how much of what people have is due to luck versus skill. It’s impossible to accurately differentiate what percentage of someone’s success can be attributed to hard work compared to circumstance. Many of the rich will admit to luck and favorable circumstances playing a large role in what they’ve accomplished.

Not to mention, if you solely measure your financial success relative to others you’ll end up on a never-ending path of feeling inadequate. Unfortunately, there will always be someone smarter than you, more popular than you, better looking than you, and someone getting richer faster than you.

And finally, everyone has different goals. Working 80-hour weeks and squeezing every penny out of your time and career is the ultimate goal for some people. But it’s a nightmare for others whose priority could be spending quality time with their family. Using a broad benchmark like income for comparison doesn’t fully reflect people’s varying goals with money.

Ok. Now that I’ve said my piece, let’s indulge ourselves with the data.

Here are the top household incomes in the United States separated by percentile:

Top 10% = $191,406

Top 5% = $290,164

Top 1% = $867,436

Since income is positively correlated with age, a better way to compare incomes would be across different age groups:

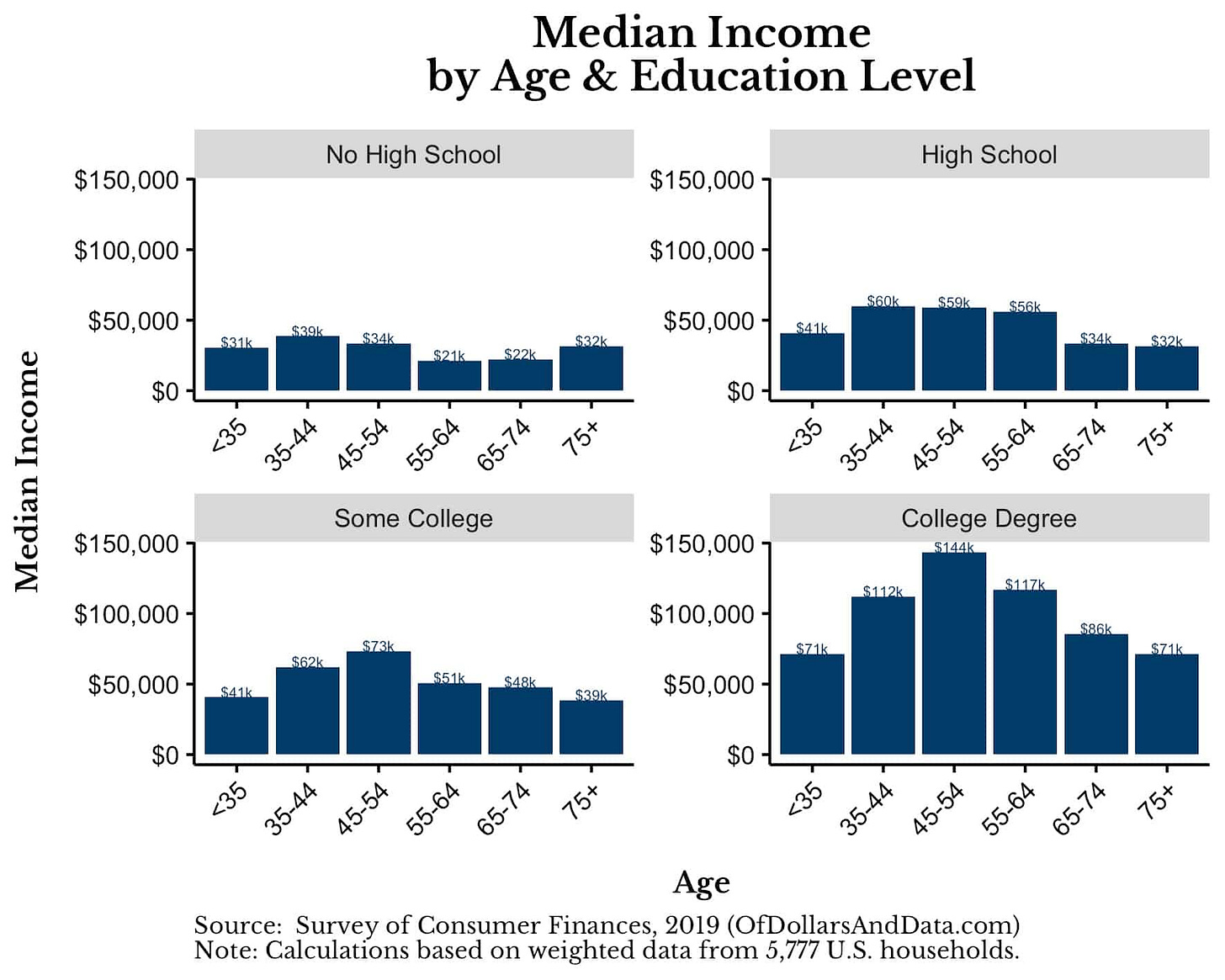

If you’re feeling discouraged by comparing yourself to the top 10% of income earners, here’s the median household income sorted by age and education level:

To be honest, I don’t have much to say about the data itself outside of the fact that it’s interesting. You can take away what you will from this information.

Although, looking over these numbers sparked a somewhat unrelated thought in my mind—the importance of income to personal finance.

I get that may seem like an obvious statement. However, if you read a lot of finance material you’ll know that almost all of the content is about saving, or investing, or investment returns, or different asset classes, or budgeting, or money-saving tips, and something that I think gets overlooked is the fact that all of those things rely on a healthy, stable income.

One of the biggest myths in personal finance is that you can be rich if you would just spend less.

In reality, the reason people aren’t able to retire is because they don’t save and invest enough money. And the primary reason people don’t save money is because they don’t make enough to save.

According to the Bureau of Labor Statistics, the bottom 40% of U.S. households spend almost all of their income on basic living necessities. There’s a baseline amount of costs in order to live a decent life that you can’t get around — you can only reduce your expenses to a certain extent.

Meaning that you need to be in the top 60% of income earners just to be able to start setting aside any money for your future. Low income, not poor spending habits, is the bigger issue.

So, if you’re looking for a secret to building wealth, prioritize increasing your income. Invest in yourself to boost your earning potential. The more you make the more you’ll have to save and invest. Unless you have a real spending problem, the best way to increase your wealth isn’t by canceling your Netflix subscription or buying off-brand toothpaste, it’s by increasing your income.

Thanks for reading!