Lifestyle Creep

I started working when I was around 15-16 years old. I worked at Great Harvest Bread Co. because I had an in with the owner (my dad). I can’t exactly remember my hourly wage but every couple of weeks I received a check for about $200. At that time, it was all I needed. I had more than enough to fill up my gas tank, go to movies, and enjoy hanging out with my friends.

During my time in college, I had several jobs ranging from SEO Fulfillment Specialist to door-to-door solar panel salesman and eventually waiter, which I ended up doing for a few years. As I went through each of these jobs my income gradually increased; however, as I made more money I didn’t feel any wealthier because I was adding expenses along the way — I got married, I had to pay rent, pay for school, get insurance, and buy groceries.

Fast forward to today and I’m making more than I did in high school and college. If my high school self could see my income today, he would probably think I’m rich. He could go to Taco Time and Jamba Juice as much as he wanted to. But my current self definitely doesn’t feel rich. It’s funny how $200 every few weeks seemed like a fortune back then, but feels like nothing now. That feeling has a lot to do with lifestyle creep.

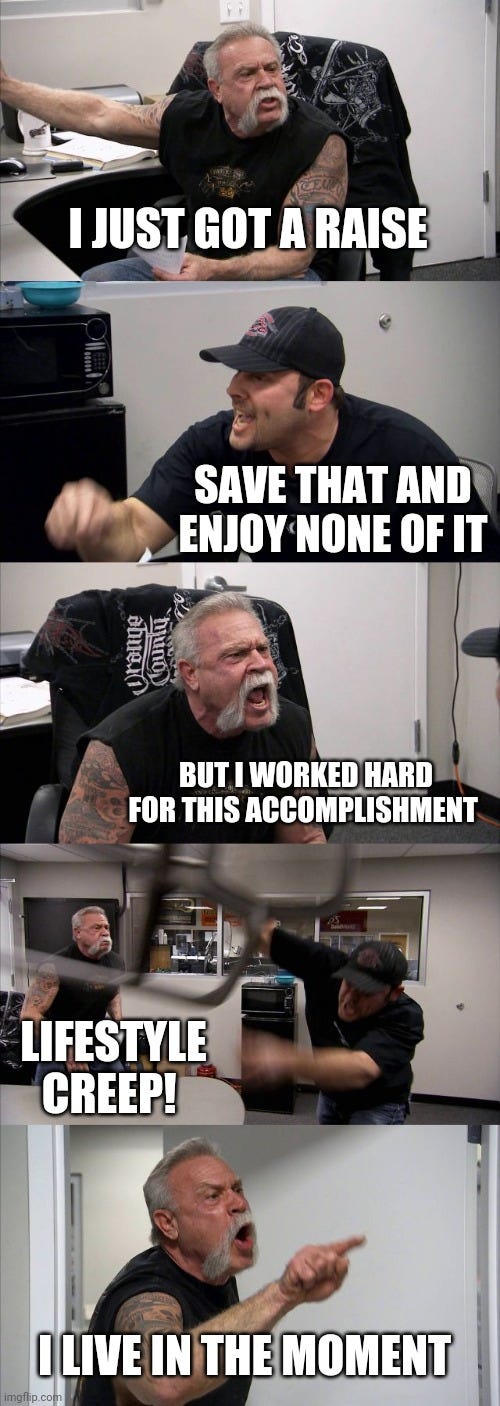

Lifestyle creep occurs when you increase your spending after experiencing an increase in income. In other words, the more you make the more you spend. It’s fascinating to look back and see how spending can “creep” upward almost imperceptibly as you move through life.

Via Giphy

While the lifestyle creep that I experienced was primarily due to adding necessary expenses as I entered new stages of life, which is largely unavoidable, increases in spending caused by a more luxurious lifestyle can be avoided.

There’s a limit to how far you can let your lifestyle drift before it starts affecting your financial future. The reason it can be so damaging is that every increase in spending negatively affects your finances twofold:

it decreases the amount of money you have left over to save each month

it increases the amount of money you’ll need to replace when you slow down or stop working

This concept also works in reverse. The more you save the less you’ll spend, and the less you spend the smaller nest egg you’ll need to live off of in retirement. Controlling lifestyle creep is essential to creating wealth.

I’m sure there are some reading this who think that a year or two of overspending won’t permanently translate into long-term spending habits. In my experience that’s not how it works. Is it possible to decrease spending? Of course. But I think it’s the exception rather than the rule. Once you’re comfortable living a certain lifestyle, it’s very difficult to cut back.

While there’s no shortage of people out there who will tell you to avoid lifestyle creep at all costs, I think that some lifestyle creep is good. As you make more money, your lifestyle should improve. What’s the point of working hard to earn more if you can’t enjoy some of it?

How can you manage lifestyle creep?

Although keeping lifestyle creep under control is hard to do in practice, the math is fairly simple. It’s all about having a plan for how you’re going to handle increases to your income.

Save a percentage of your income

Start by saving a percentage of your income. Your savings goal should be based on a percentage of your income rather than a set dollar amount. That way, when your income climbs, you can adjust your savings amount to match the percentage you’ve set for yourself.

Save half of your raises

As your income increases, and subsequently your spending, your savings rate should increase as well.

Although there are more complicated ways to determine exactly how much of your raises you should save, saving 50% works for most people, most of the time. It’s simple and easy to remember. Doing so will allow for some healthy lifestyle improvements while also increasing your savings rate.

Example:

You make $5,000 per month and you save 20% ($1,000).

You get a $500 raise and you save half ($250).

You’re now saving $1,250 of the $5,500 you make per month and have increased your savings rate to 22.7%!

Controlling lifestyle creep is as much a mindset as it is a math equation. Be intentional with your spending. Align your use of capital with what you value. Instead of aiming for a target income, I would suggest aiming for your ideal lifestyle. Then you can figure out what job or income you need to support that lifestyle.

Good financial planning is finding the right balance between enjoying life today while still preparing responsibly for the future.

Thanks for reading!