Investing at All-Time Highs

In a turn of events I don’t believe anyone could have predicted at the beginning of the pandemic, the U.S. stock market has been on a tear ever since — rising around 50%+ since the lows last March and hitting 28 new all-time highs. When the markets are performing as well as they have been, instead of feeling excitement and an eagerness to jump in, I sense feelings of hesitation and nervousness amongst investors.

Why is that?

The rationale I usually hear from investors who are feeling squeamish about investing when the stock market is reaching new highs is something along the lines of “all of the gains have been had. I missed the opportunity.”

This is true. They have missed out. But that’s no reason to believe the market can’t keep moving upward. History suggests that investing at all-time highs is as good a time as any to put your cash to work, especially if you’re investing for the long run.

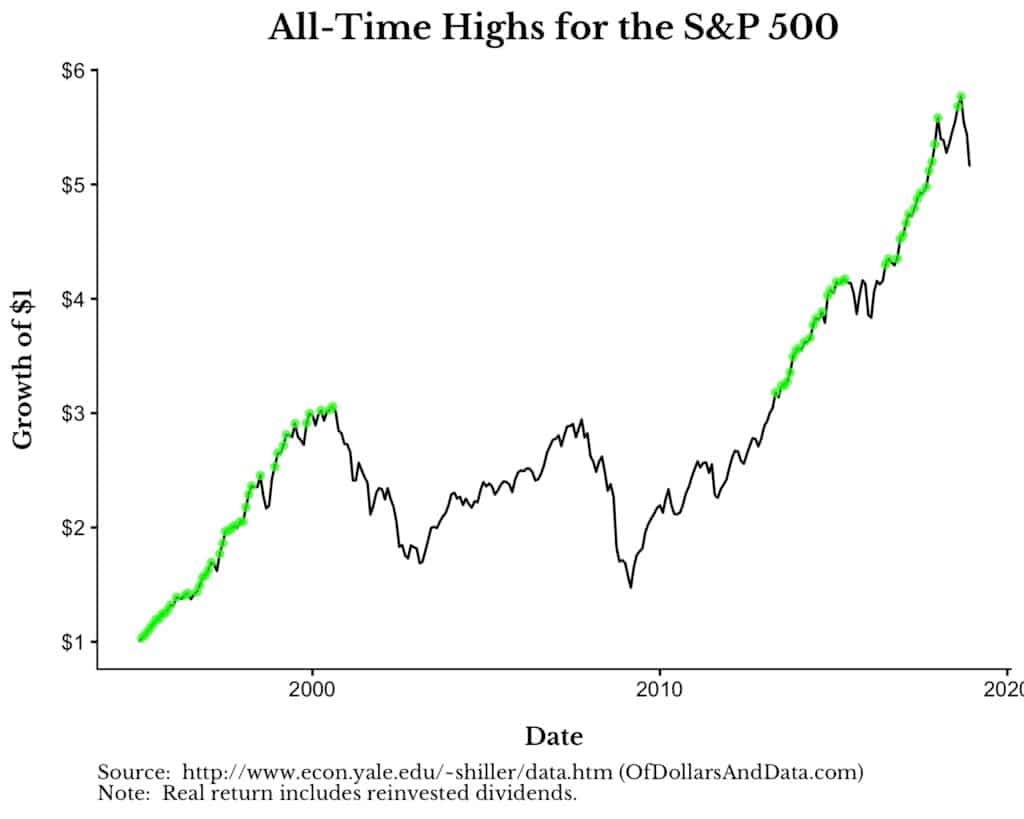

Below is a graph of S&P 500 performance from 1995 to 2018. Each green dot signifies a new all-time high.

While each green dot probably seemed like the top of the market or a “bubble” when it was happening, when you take a step back and look at the market over a long period of time, you can see how each “high” is relative. The “highs” of the late 90s and early 2000s are now our lows.

When someone says the market is too “high” to invest in right now, I would ask compared to what? Yes, the market has reached its highest point up until now, but history has told us that it’s highly unlikely to still be the high 20 years from now. If you’re hesitant to invest because the market is too “high”, you’re likely to miss out on the new highs that are almost certain to follow.

I always hear about people who are nervous to invest because they’re afraid the market might drop. What I don’t hear very often are people who are eager to invest because they’re scared of getting left behind. Statistically speaking, that’s a far greater risk over the long run than losing your money. Short term safety can lead to long term risk.

To paraphrase Ferris Bueller, the stock market moves pretty fast. If you don’t stop and invest every once in a while, you could miss it.

If you’re still feeling timid about investing at all-time highs and thinking to yourself “wouldn’t it just be better to wait for a small correction?” The short answer is no, not really.

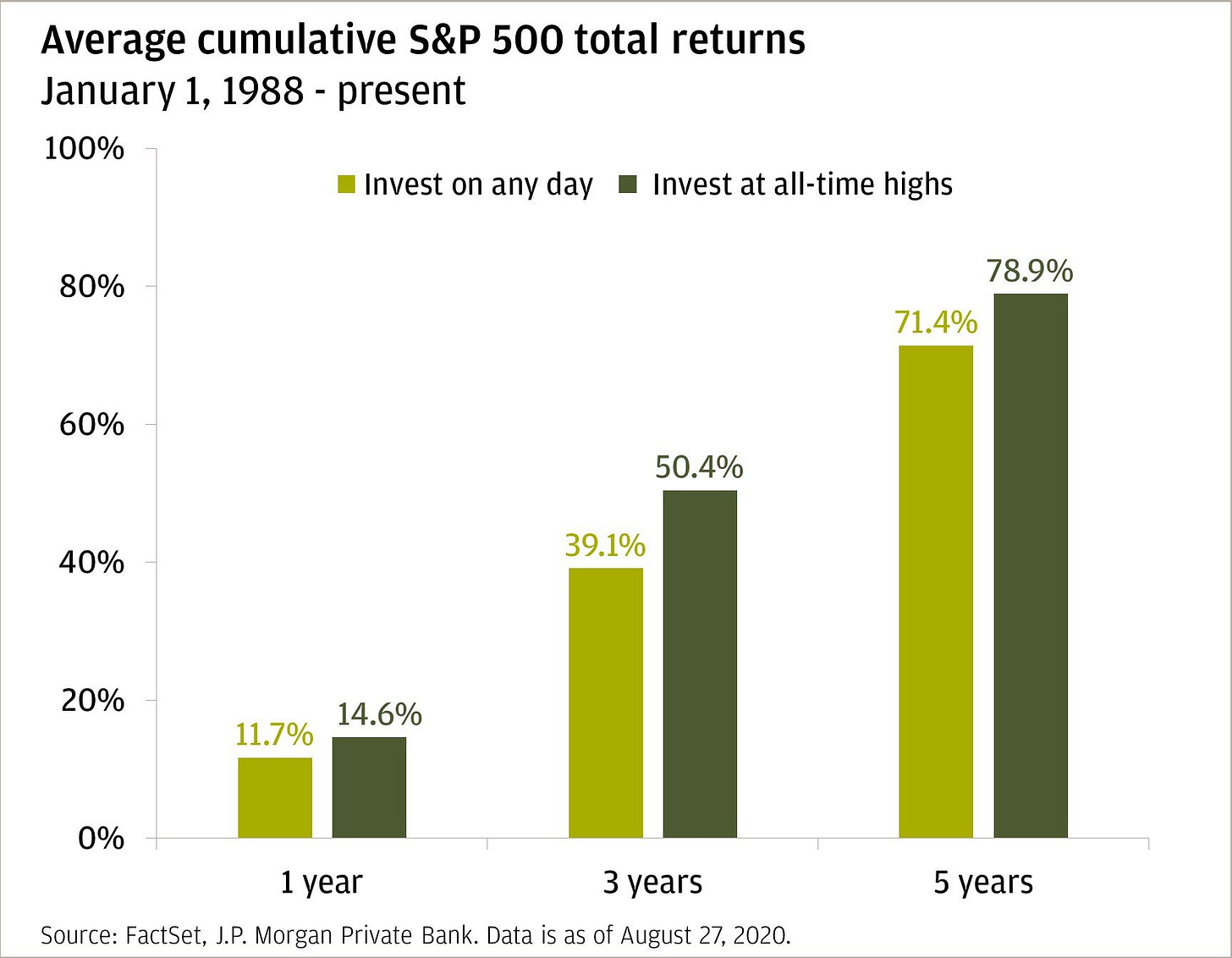

In fact, according to JP Morgan, investing at all-time highs has been more profitable than investing at any other time.

No, your eyes aren’t deceiving you. Data shows that if you invested in the S&P 500 on days where it closed at all-time highs your investment made money over the course of the next year 88% of the time — and your total return was actually higher than if you would have invested any other day.

This is largely due to the fact that when you’re investing at all-time highs, the market is usually trending upward. All-time highs typically occur in bunches. As you can see from the first graph, the green dots are bunched close together and oftentimes one new all-time high can signify that more will shortly follow.

If you believe that the market goes up over time and if you have a long-term investment horizon, the specific day you choose to invest isn’t going to matter. When you’re investing over a 20-30 year time period, the “highs” or “lows” from year one or year five will seem pretty insignificant by the end.

Ideally, the aim has always been to buy low and to sell high; however, that’s an impossible strategy to execute consistently. And that’s ok. The good news is you don’t need to try and find the bottom. Instead of buying low and selling high, you can simply buy high and sell even higher.

Thanks for reading!