Interest in the stock market and trading activity has surged since the beginning of the coronavirus pandemic. Major brokerage firms saw record account openings in the first quarter, including Robinhood who had three million new accounts opened, crushing the next closest competitor.

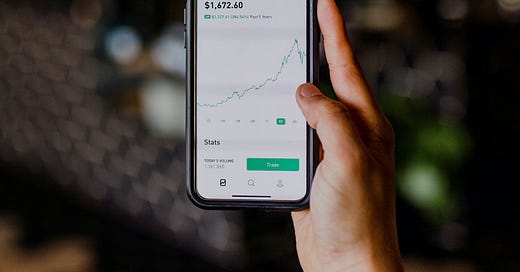

All the talk in the finance world in recent months has been about day traders, Robinhood, and Dave Portnoy. Day trading is the act of both buying and selling a stock the same day — although the term is used generally to describe high-risk, short-term investing. Robinhood has become the most popular online platform for a host of new day traders. Dave Portnoy, the founder of Barstool Sports, who is regularly a sports talk show host has turned to day trading while sports betting has been on hold. He has quickly grown his following and has become one of the most influential financial personalities on Twitter by streaming his day trading adventures.

Via Barstool Sports

Why the increased interest?

There are many reasons and variables as to why interest in the stock market and trading has seen an uptick. A few of the best and simplest explanations I’ve heard are:

Boredom

An extremely volatile market

Lack of live sports to bet on

Simply put, a lot of people have started working from home and have more time on their hands. With little else to do and the stock market in a state of extreme volatility (fast up and down movements of stock prices) due to the pandemic, many newcomers have seen this as a great time to enter the world of investing.

On top of that, the absence of live sports has made the stock market the only game in town. The median age of Robinhood users has drifted up from 27 in 2017 to 31 now, with 80% of its users being male. This is essentially the same demographic that is most likely to bet on sports on a regular basis. Robinhood’s interface makes the switch from sports betting to trading stocks seamless, which has been great for business. Media mentions of the word “Robinhood” have surpassed mentions of the word “Vanguard.”

Consequently, Robinhood has been subject to a lot of criticism for how the app has “gamified” stock trading and blurred the line between gambling and investing. The main criticism comes from a feeling that Robinhood takes advantage of its young, inexperienced audience. Half of the three million new account openings were first-time traders. Robinhood doesn’t charge fees for trading but is still paid more if its customers trade more. The app’s gaming features encourage investors to trade and to keep trading. Robinhood users buy and sell the riskiest products and do so more frequently than those at any other brokerage firm.

Is this newfound interest in the stock market and frequent trading good?

Studies have shown that the more often amateur investors trade stocks, the worse their returns are likely to be.

These statistics show the issues which can arise when amateurs start trading stocks:

Excessive trading shares in the addictive qualities of gambling.

12% of all trading activity is from day-traders, yet day-traders are only 1.6% of all profitable traders.

About only 1 in 20 day traders remain profitable in the long run.

Men trade more than women, and unmarried men trade more than married men.

Via Giphy

Learning to invest is a crucial skill for building and maintaining wealth. Successful long-term investing is about controlling what you can control, having a process, and sticking to that process as you block out external noise. Many first-time investors who start out using Robinhood are potentially forming bad habits that will be detrimental to their long-term success in the stock market. Frequent trading based on what’s happening in the news and gut-feelings is not a sustainable investing process and creates habits that are more in line with gambling than rational investor behavior.

“If you’re relying on your gut rather than a rule-based approach to investing, you can be almost certain that your feelings of risk or safety are exactly the opposite of what they ought to be… The fact that people are fallible is your biggest enduring advantage in the accumulation of greater wealth. The fact that you are just as fallible is the biggest impediment to that very same goal.

Get rich fast and get poor fast are opposing sides of the same coin.” - Daniel Crosby

In short, more education surrounding investing is the key. I don’t think that Robinhood or Dave Portnoy or trading stocks are bad in and of themselves. I actually really like Dave’s videos; they make me laugh. But they should be viewed as entertainment instead of stock-picking advice. Despite the poor investing behavior Robinhood encourages which can be a trap for new investors, it has done a lot to reduce trading commissions across the industry as well as give many access to the stock market who didn’t have access previously. I used it to buy my first stock. In the end, it’s just a tool. Some will use it to their benefit, and some will lose money trying to get rich quick. Education being the main differentiator between the two.

"The stock market is a device for transferring money from the impatient to the patient." - Warren Buffett.

Thanks for reading!

love that Warren Buffet quote. It's also probably easier to be patient when you're a million years old and have lots of green.

Legend has it that women make better investors that men, simply because they put money in and either don't think about it or forget about it until it has grown immensely...