Crazy Investor Expectations

I hope everyone is enjoying their long, 4th of July weekend. I don’t have a lot of time to write this week due to a family vacation (I know, life’s hard), and because my holiday posts typically don’t get read as much as normal Mondays posts, I’m going to keep this one shorter than usual.

A recent global survey of individual investors polled 8,550 people across 24 countries with the goal of understanding their views on the markets and investing. The results are interesting…

The following chart shows investor expectations for real returns (after taxes and inflation) over the long term:

If these results really do reflect the opinion of the majority of individual investors, I have a feeling a lot of people are about to be disappointed.

Not surprisingly, the 750 U.S. investors that were surveyed had the highest long-term expectations at 17.5%. I’m confident that the reason for these return expectations can be attributed to recency bias. Recency bias in investing is when people think what’s happened in the recent history of the market will continue on into the future.

Since the S&P 500 has returned about 17% per year over the last 5 years, I can see how investors, especially newer investors, would think that this is normal and will continue to happen.

However, the absolute best 30 year period for the S&P 500 saw average returns of 13.6% per year from 1975 to 2004. Over the entire history of the S&P 500, the average annual return is basically 10%. And keep in mind, these returns are before taxes and inflation.

So, if you’re expecting 17.5% long-term returns after taxes and inflation, I would say you probably need to lower your expectations.

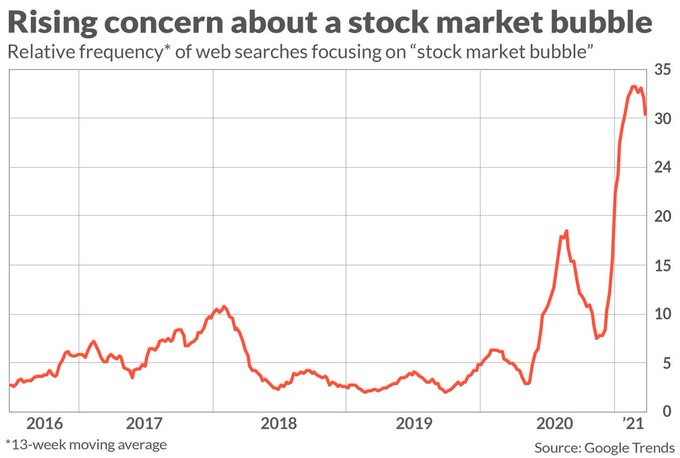

Yet, for as many people who have super high expectations going forward, there are plenty of people who expect just the opposite. Personally, I’ve had more conversations about people expecting the market to crash than to perform well over the next few years.

Expecting returns that are too high or too low can be problematic. If you think the market will make you rich in a few short years and it doesn’t, you may give up on investing. If you think the market is too risky and won’t offer a substantial return then you may not invest in the first place.

My response to people in each of these camps would be to ignore your expectations and invest anyway. And stay invested for as long as possible.

A long time horizon solves most investing worries. Historically, the worst 30-year rolling return for the S&P 500 was still 8% per year. And remember, 8% compounded over 30 years can produce extraordinary results.

I want to end with one of the craziest statistics I’ve seen in a while:

The U.S. dollar has lost 98% of its purchasing power since 1900 while the S&P 500 has returned 219,131% after inflation since 1900.

Whatever your investing expectations may be going forward, not investing is risky.

Thanks for reading!

*Even though this has nothing to do with what I wrote about, here’s a link to one of my favorite movie scenes that I can’t help but think about every 4th of July.